operating cash flow ratio ideal

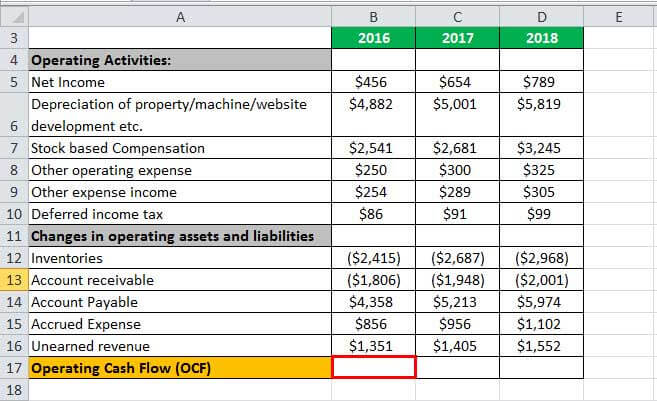

Operating cash flow ratio CFO Current liabilities. This ratio calculates how much cash a business makes as a result of sales.

Price To Cash Flow Formula Example Calculate P Cf Ratio

It is also sometimes described as cash flows from operating activities in the statement of cash flows.

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-b760da2ee7244a7093d6df0804bb361b.jpg)

. Although there is no one-size-fits-all ideal ratio for every company out there as a general rule the higher the Operating Cash Flow Margin the better. Operating Cash Flow Margin Cash Flow from Operations Net Sales. The ideal ratio is close to one.

Operating cash flow ratio. Operating cash flow Net cash from operations Current liabilities Ideally your operating cash flow ratio should be fairly close to 11 meaning you make 10p per 1 you make. Cash Flow to Debt Ratio 25 or 25 4 Capital Expenditure Ratio.

A preferred operating cash flow number is greater than one because it means a business is doing well and the company is enough money to operate. A ratio less than 1 indicates short-term cash flow problems. The Formula to Calculate the Operating Cash Flow Ratio.

The operating cash flow ratio is a measure of a companys liquidity. If the operating cash flow is less than 1 the company has generated less cash in the period than it needs to pay off its short-term liabilities. Below 1 indicates that firms current liabilities are not covered by the cash generated from its operations.

The key here is to focus on your companys regular business operations. If ancillary cash flows were to be included in operating cash flows it would imply that the entity is relying on non-core activities to support its core activities. A ratio smaller than 10 means that your business spends more than it makes from operations.

The cash flow-to-debt ratio indicates how much time it would take a company to pay off all of its debt if it used all of its operating cash flow for. There is no standard guideline for operating cash flow ratio it is always good to cover 100 of firms current liabilities with cash generated from operations. If this ratio increases over time thats an indication that your business is getting better and better at converting.

Ideally the ratio should be fairly close to 11. Start by calculating your incoming cashyour CFO. A higher ratio is more desirable.

This may signal a need for more capital. A much smaller ratio indicates that a business is deriving much of its cash flow from sources other than its core operating capabilities. Operating cash flow Sales Ratio Operating Cash Flows Sales Revenue x 100.

The formula for your operating cash flow ratio is a simple one. The figure for operating cash flows can be found in the statement of cash flows. So a ratio of 1 above is within the desirable range.

The operating cash flow ratio for Walmart is 036 or 278 billion divided by 775 billion. Often termed as CF to capex ratio capital expenditure ratio measures a firms ability to buy its long term assets using the cash flow generated from the core activities of the business. Targets operating cash flow ratio works out to.

Thus investors and analysts typically prefer higher operating cash flow ratios. CFO CL OCF Ratio. If it is higher the company generates more cash than it needs to pay off current liabilities.

Over time a businesss cash flow ratio amount should increase as it demonstrates financial growth. The figure for sales revenue can be found in the. Cash Flow from Operations CFO divided by Current Liabilities CL or.

Example of the Operating Cash. A ratio greater than 1 indicates good financial health as it indicates cash flow more than sufficient to meet short-term financial obligations. This ratio can be calculated from the following formula.

Low cash flow from operations ratio ie. This is because it shows a better ability to cover current liabilities using the money generated in the same period.

Cash Flow Formula How To Calculate Cash Flow With Examples

Operating Cash Flow Formula Calculation With Examples

Operating Cash Flow Ratio Formula Guide For Financial Analysts

Price To Cash Flow Formula Example Calculate P Cf Ratio

Fcf Formula Formula For Free Cash Flow Examples And Guide

Price To Cash Flow Ratio Formula Example Calculation Analysis

Operating Cash Flow Formula Calculation With Examples

Operating Cash Flow Ratio Formula Guide For Financial Analysts

Cash Flow Per Share Formula Example How To Calculate

Operating Cash Flow Ratio Definition Formula Example

Cash Flow Formula How To Calculate Cash Flow With Examples

Operating Cash Flow Definition Formula And Examples

Operating Cash Flow Efinancemanagement Com

Operating Cash Flow Ratio Definition And Meaning Capital Com

Free Cash Flow Formula Calculator Excel Template

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

Net Cash Flow Formula Calculator Examples With Excel Template